What is Part D?

Medicare Part D prescription drug coverage, often referred to as Part D, is provided and coordinated by Medicare-approved private insurance companies. Any beneficiary who is eligible for Original Medicare, Part A and/or Part B, and permanently resides in the service area of a Medicare Prescription Drug Plan, can sign-up for Medicare Part D. Medicare Part D coverage is optional, but if you don’t enroll in Part D as soon as you’re eligible, you might pay a late-enrollment penalty if you enroll later.

You can get Medicare Part D coverage through a stand-alone Medicare Prescription Drug Plan if you’re enrolled in Original Medicare. If you’re enrolled in a Medicare Advantage plan, you can get this coverage through a plan that includes drug benefits, also known as a Medicare Advantage Prescription Drug Plan. Different insurers offer different types of plans, so your monthly plan premium and out-of-pocket expenses for prescription drugs will vary from plan to plan.

Every Medicare Prescription Drug Plan has a formulary — that is, a list of covered drugs. The formularies vary among plans. The formulary may change at any time. You will receive notice from your plan when necessary.

PRO TIP

It’s important to review the beneficiary’s plan formulary on a yearly basis as these change from time to time. This is true for both Medicare Supplements with a standalone PDP and for Medicare Advantage Prescription Drug Plans (MAPD).

The Coverage Gap

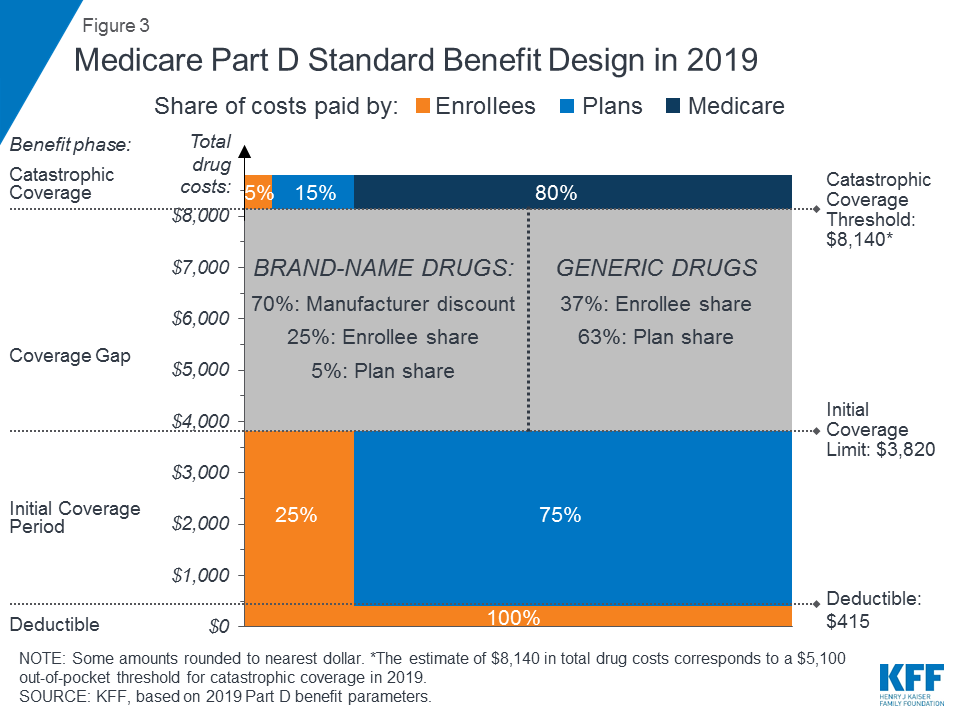

You may have heard of the Medicare coverage gap (also called the “donut hole”) but aren’t clear on how it works. After your Medicare Part D coverage has paid a certain amount for prescription drugs, you may have to pay all costs yourself, up to a yearly limit. This temporary limit on what your Medicare Prescription Drug Plan will pay for covered drugs is the coverage gap. The coverage gap applies to both stand-alone Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug Plans.

Part D and Low Income Subsidy

Enrollment in Medicare Part D plans is voluntary, with the exception of beneficiaries who are eligible for both Medicare and Medicaid and certain other low-income beneficiaries who are automatically enrolled in a PDP if they do not choose a plan on their own. Unless beneficiaries have drug coverage from another source that is at least as good as standard Part D coverage (“creditable coverage”), they face a penalty equal to 1% of the national average premium for each month they delay enrollment.

In 2018, 43 million Medicare beneficiaries are enrolled in Medicare Part D plans, including employer-only group plans. Another 1.5 million beneficiaries are estimated to have drug coverage through employer-sponsored retiree plans where the employer receives subsidies equal to 28% of drug expenses between $415 and $8,500 per retiree (in 2019). Several million beneficiaries are estimated to have other sources of drug coverage, including employer plans for active workers, FEHBP, TRICARE, and Veterans Affairs (VA). Yet 12% of people with Medicare are estimated to lack creditable drug coverage.

An estimated 13 million Part D enrollees receive the Low-Income Subsidy in 2018. Beneficiaries who are dually eligible, QMBs, SLMBs, QIs, and SSI-onlys automatically qualify for the additional assistance, and Medicare automatically enrolls them into PDPs with premiums at or below the regional average (the Low-Income Subsidy benchmark) if they do not choose a plan on their own. Other beneficiaries are subject to both an income and asset test and need to apply for the Low-Income Subsidy through either the Social Security Administration or Medicaid.