What is Medicare Part C or Medicare Advantage?

Medicare Advantage plans are private health plans that have contracts with Medicare. When you join one, you get your Medicare-covered healthcare services through the private plan.

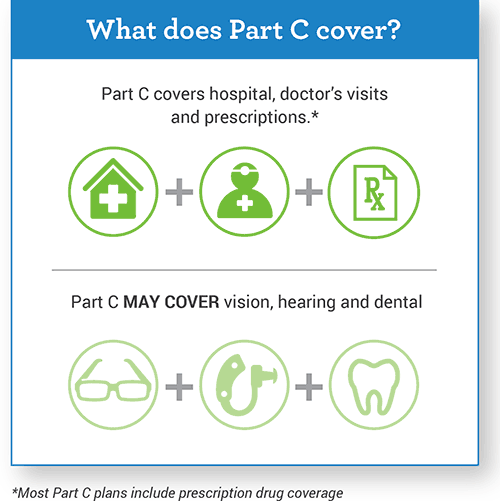

Medicare Part C plans must cover all the same things as Medicare Part A and B. They also may cover services that Original Medicare does not pay for. Examples are eye exams, a pair of eyeglasses each year or a hearing exam. They may charge different amounts than you would pay through Original Medicare.

Medicare Advantage plans may also cover prescription drugs. If they do, you cannot buy a separate Medicare prescription drug plan.

With Medicare Part C plans, you generally must use certain providers. These are doctors, hospitals, drug stores and other healthcare providers that the plans have contracts with. These are called in-network providers. If you use providers outside your plan’s network, it may cost you more money. It also may mean you get no Medicare coverage at all for that service.

You must have Medicare Parts A and B to join a Medicare Advantage plan. You pay your usual Part B premium plus any additional premium that the plan may charge.

What are the different type of Medicare Advantage Plans?

HMO - Health Maintenance Organization:

If you do not get your care from a provider the HMO approves, called an in-network provider, Medicare will not cover it. You usually need a referral from your primary care provider to see a specialist.MSA - Medical Savings Accounts:

You must pay a very high deductible before the plan covers any benefits. A health savings account is linked to the plan. Medicare puts money in the savings account each year, but the amount is less than your annual deductible.PPO - Preferred Provider Organizations:

You can get care from a Medicare provider out of your network. But you will pay more for out-of-network care. You will not need a primary care doctor.PFFS - Private Fee-for-Service Plans:

There is no network of providers. You can see any Medicare provider who agrees to the plan’s terms and payments. Providers can decide on a case-by-case and visit-by-visit basis whether or not to see you.SNPS - Special Needs Plans:

These are PPOs or HMOs that only admit people with Medicare who:Have certain serious chronic medical conditions, or

People who have Medicaid and Medicare, or

People who live:

In certain nursing homes or

At home but have high care needs and could qualify for a nursing home.

Can I join a SNP?

You can join a SNP if you have Medicare Parts A and B, live in the SNP service area and meet the plan’s eligibility requirements. See the eligibility requirements for SNPs on Medicare.gov.

Are SNPs available everywhere?

Not necessarily. Each year, different types of Medicare SNPs may be available in different parts of the country.

Insurance companies can decide that a plan will be available to everyone with Medicare in a particular state or only in certain counties. Insurance companies may also offer more than one plan in an area, with different benefits and costs. Each year, insurance companies offering Medicare SNPs can decide to join or leave Medicare.

Can you have Medicare Advantage as well as a Medigap Plan?

No. If you choose to enroll in a Medicare Advantage plan, you cannot also buy a Medigap/supplemental insurance policy. If you choose to enroll in Medicare Advantage, you will have limited opportunities to get a Medigappolicy in the future if you wish to switch back to Original Medicare.